Ethereum Price Analysis: 7-Day Drop Raises Investor Concerns 😬📉

By Jason Miller – Crypto Writer 10.expert 🧠 Covering Bitcoin, altcoins, blockchain & Web3

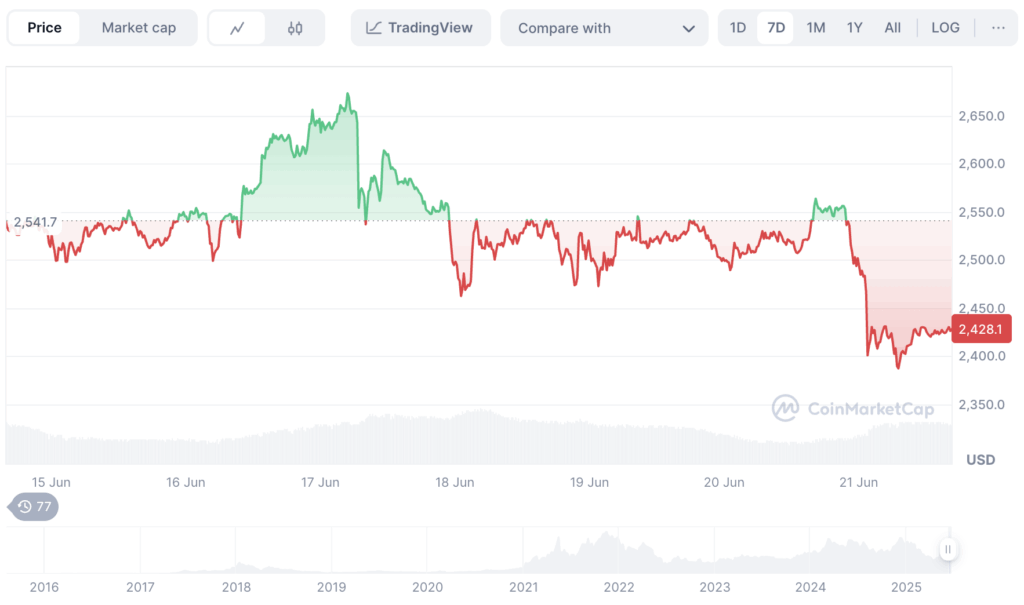

Over the past 7 days, Ethereum (ETH) has faced notable volatility, ending with a sharp decline that has caught the attention of both traders and long-term holders.

📊 Quick Summary:

- Start price (June 15): ~$2,541

- Lowest point: ~$2,404

- Current price (June 21): ~$2,428

- Weekly change: -4.5%

📉 1. Early Strength Fades Midweek

From June 15 to early June 17, ETH showed mild growth, climbing above the $2,550 level. However, resistance around this mark proved strong, causing the price to retract quickly.

💥 2. Sudden Sell-Off (June 18–19)

A sharp downward move occurred around June 18, breaking below the $2,500 support zone. This sell-off pushed ETH as low as $2,404, a level not seen since May.

📉 3. Bearish Momentum Builds

The red trend persisted for most of the week. Every attempt to recover was met with immediate selling pressure, signaling low buyer confidence amid macro uncertainty.

🔍 4. Trading Volume Insights

Volume remained relatively stable, suggesting no panic selling, but the lack of strong buyer inflow limited upward momentum.

📉 5. Final Drop (June 20–21)

On June 20, ETH attempted a brief recovery, even touching above $2,550 again. However, the rally failed, and ETH closed at $2,428 on June 21, reflecting bearish dominance.

📈 What’s Next?

- Short-term support: $2,400

- Next resistance: $2,500

- Technical sentiment: Bearish-to-neutral

- Investor outlook: Cautious — watching for macro signals (Fed rates, BTC trend, ETF news)

🧠 Jason’s Take

Ethereum’s dip is concerning, but not unusual in current market conditions. We’re in a consolidation phase — accumulation opportunities may emerge if ETH holds above $2,400. Long-term holders shouldn’t panic, but day traders need tight risk management this week.

Stay smart, stay informed.

– Jason Miller, 10.expert