How to Earn Passive Income with Crypto Staking

By Jason Miller – Crypto Writer 10.expert 🧠 Covering Bitcoin, altcoins, blockchain & Web3.

As a crypto writer and analyst, I’m constantly exploring new avenues for generating returns in the digital asset space. While trading and active investment demand constant attention, the allure of passive income in crypto is undeniable. Among the most popular and accessible methods for achieving this is staking. It’s essentially the crypto equivalent of earning interest in a savings account, but with potentially much higher yields and direct participation in blockchain security.

How to Earn Passive Income with Crypto Staking 💰🌱

Staking has emerged as a cornerstone of the Proof-of-Stake (PoS) consensus mechanism, a greener and often more scalable alternative to Bitcoin’s Proof-of-Work (PoW). If you’re holding PoS cryptocurrencies, staking is a fantastic way to put your assets to work for you. Let’s break down how you can get started and what you need to know.

1. Understanding the Basics: What is Staking? 🧠

At its core, staking involves “locking up” a certain amount of your cryptocurrency to support the operations of a blockchain network. In return for securing the network and validating transactions, you earn rewards, typically in the form of newly minted tokens of the same cryptocurrency you’re staking.

2. Proof-of-Stake: The Engine Behind Staking ⚙️

Unlike Proof-of-Work (which relies on miners solving complex puzzles), Proof-of-Stake requires validators to “stake” their crypto as collateral. The more crypto a validator stakes, the higher their chance of being selected to validate the next block and earn rewards. This mechanism promotes network security and decentralization.

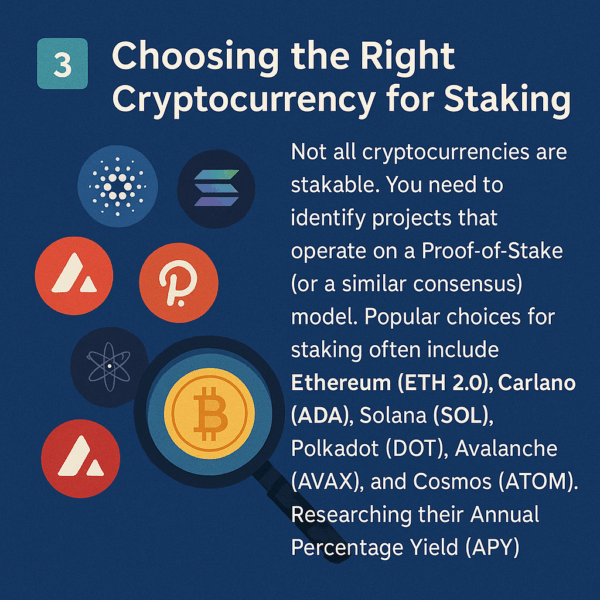

3. Choosing the Right Cryptocurrency for Staking ✅

Not all cryptocurrencies are stakable. You need to identify projects that operate on a Proof-of-Stake (or a similar consensus) model. Popular choices for staking often include Ethereum (ETH 2.0), Cardano (ADA), Solana (SOL), Polkadot (DOT), Avalanche (AVAX), and Cosmos (ATOM). Researching their Annual Percentage Yield (APY) is crucial.

4. Deciphering APY and Rewards: What to Expect 📊

Staking rewards are usually expressed as an Annual Percentage Yield (APY). This can vary significantly depending on the cryptocurrency, the total amount staked on the network, and the staking period. Some platforms offer fixed rates, while others are variable. Always consider whether the APY can truly outpace inflation.

5. Centralized Exchanges: The Easiest Entry Point for Staking 🚀

Many popular centralized crypto exchanges (CEXs) like Binance, Coinbase, Kraken, and Crypto.com offer staking services. This is often the simplest way for beginners to start, as the exchange handles the technical complexities of running a validator node.

6. Decentralized Staking Solutions: For More Control 🌐

For those seeking greater control and decentralization, platforms like Lido (for liquid staking Ethereum) or directly delegating to a validator through a project’s native wallet allow you to stake while maintaining custody of your keys.

7. Liquid Staking: Unlocking Your Staked Assets 💧

One of the innovations in staking is “liquid staking.” This allows you to stake your cryptocurrency but receive a liquid token in return (e.g., stETH for staked ETH). This liquid token can then be used in other DeFi protocols, providing even more opportunities for yield generation while your original assets remain staked.

8. Delegated Staking: Participating Without Running a Node 🤝

If you don’t have enough tokens to run your own validator node (which can be substantial, like 32 ETH for Ethereum) or lack the technical expertise, delegated staking is your friend. You “delegate” your tokens to a professional validator who runs the node on your behalf, and you share in the rewards.

9. Understanding Lock-up Periods: Your Funds May Be Tied Up ⏳

Be aware that many staking options involve “lock-up periods,” where your staked assets are inaccessible for a certain duration. This can range from a few days to several weeks or even months. Understand these terms before committing your funds, as it affects your liquidity.

10. The Risk of Slashing: Why Validator Uptime Matters ⚡

A critical risk in staking is “slashing.” If a validator behaves maliciously (e.g., attempts to double-sign transactions) or goes offline for extended periods, a portion of the staked funds (both the validator’s and delegators’) can be “slashed” or penalized by the network. Choose reputable validators with a strong uptime history.

While staking earns you more tokens, the price of the underlying asset can still fluctuate dramatically. If the value of your staked cryptocurrency drops significantly, your overall portfolio might still be down, even with staking rewards. This is market risk, and it’s paramount to understand.

12. Tax Implications of Staking Rewards 🧾

Remember that staking rewards are generally considered taxable income in most jurisdictions (like the U.S.) when you receive them. Consult with a tax professional to understand your obligations.

13. Compounding Your Rewards for Accelerated Growth 📈

Many staking platforms allow you to “re-stake” your earned rewards, effectively compounding your returns over time. This can significantly boost your passive income over the long run, leveraging the power of compound interest.

14. Diversification: Don’t Put All Your Eggs in One Basket 🧺

While staking can be lucrative, it’s wise to diversify your passive income strategies across different cryptocurrencies and platforms. This helps mitigate risks associated with a single project or platform.

15. Do Your Own Research (DYOR): The Golden Rule of Crypto 📚

Before staking any amount, no matter how small, thoroughly research the project, the staking mechanism, the platform you’re using, and the potential risks. Look at community sentiment, audited smart contracts, and the long-term viability of the project.

Staking offers an exciting pathway to generating passive income in the crypto world, allowing you to grow your holdings simply by being a participant in a decentralized network. By understanding the mechanics, choosing wisely, and managing risks, you can make your crypto work harder for you.