How to Use Grid Trading

By Jason Miller – Crypto Writer 10.expert 🧠 Covering Bitcoin, altcoins, blockchain & Web3.

As a crypto writer and analyst, I’ve observed that one of the most intriguing and often misunderstood strategies in automated trading is Grid Trading. It’s a method that embraces volatility rather than shying away from it, aiming to profit from the continuous ebb and flow of prices within a defined range. While it might sound complex, the core principle is quite intuitive: buy low, sell high, repeatedly, as price oscillates.

Grid trading is particularly well-suited for the 24/7, highly volatile crypto markets. It automates repetitive tasks and removes emotional decision-making, which can be a huge advantage. However, like any trading strategy, it comes with its own set of nuances and risks that need to be understood.

How to Use Grid Trading: Harnessing Crypto Volatility for Profit 🎣📊

Grid trading is a quantitative trading strategy that involves placing a series of buy and sell orders at predetermined price levels, creating a “grid” of orders across a price range. The goal is to profit from small price movements within that range.

Understanding the Core Concept: Buy Low, Sell High, Repeatedly 🔄

Imagine setting up a fishing net with many different levels. When the “fish” (price) swims down to a lower level, you “buy” (catch it). When it swims up to a higher level, you “sell” (release it for profit). This continuous process of buying and selling within a defined range is the essence of grid trading.

Identifying the Ideal Market Conditions: Sideways and Volatile 🌊

Grid trading excels in ranging (sideways) markets or those with choppy, oscillating volatility without a clear strong trend in one direction. It thrives on prices moving up and down within a horizontal channel. It is generally not recommended for strong trending markets (either up or down) unless specifically configured as a trend-following grid.

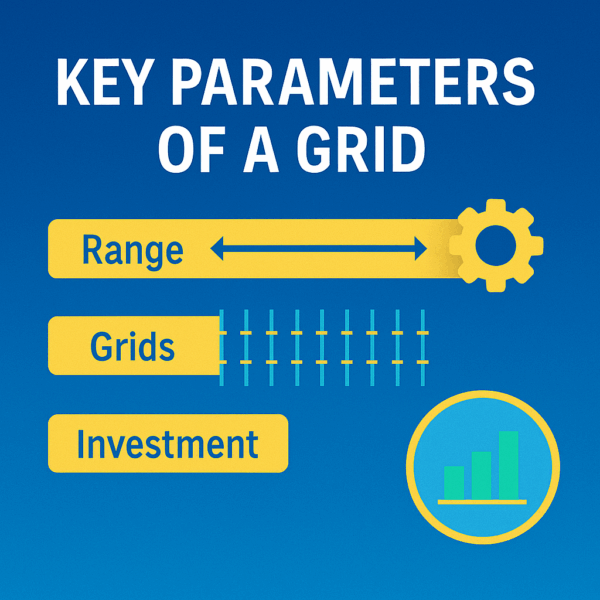

Key Parameters of a Grid: Range, Grids, and Investment ⚙️

To set up a grid, you’ll define:

* Upper Price Limit (Ceiling): The highest price at which your grid will operate and where the highest sell orders are placed.

* Lower Price Limit (Floor): The lowest price at which your grid will operate and where the lowest buy orders are placed.

* Number of Grids/Grid Quantity: How many individual buy and sell levels you want within your defined range. More grids mean smaller profit per trade but more frequent trades. Fewer grids mean larger profit per trade but fewer trades.

* Grid Interval/Spacing: The price difference between each grid line. This can be arithmetic (equal price difference) or geometric (equal percentage difference).

* Investment Amount: The total capital you’re allocating to the grid.

How a Grid Bot Works Step-by-Step 🤖

When you launch a grid bot:

* It analyzes the current price relative to your defined range.

* It places buy limit orders at intervals below the current price and sell limit orders at intervals above the current price.

* As the price drops and fills a buy order, the bot automatically places a corresponding sell order at a higher grid level.

* As the price rises and fills a sell order, the bot automatically places a corresponding buy order at a lower grid level.

* This continuous cycle aims to capture small profits from each completed buy-then-sell or sell-then-buy cycle.

Choosing the Right Cryptocurrency Pair 🪙

Select pairs that typically exhibit ranging behavior or consistent volatility. Highly liquid pairs like BTC/USDT, ETH/USDT, or stablecoin pairs (e.g., USDT/BUSD) are often good choices due to their consistent volume and less erratic, but still oscillating, movements. Avoid extremely low-volume, illiquid, or newly launched tokens for grid trading unless you fully understand the risks.

Spot Grid vs. Futures Grid: Understanding the Differences 🆚

- Spot Grid: Trades on the spot market, where you own the underlying assets. Lower risk as you’re not using leverage, but profits are lower. If the price leaves the grid downwards, you’re left holding the assets.

- Futures Grid: Trades on the futures market with leverage. This amplifies potential profits but also significantly increases liquidation risk. Requires more careful management and risk assessment.

Setting Your Price Range: Analysis is Key 🔍

The most critical step. Analyze the asset’s historical price action to identify typical ranges, support, and resistance levels. Use technical analysis (e.g., Bollinger Bands, horizontal support/resistance) to define a realistic and wide enough range that the price is likely to stay within for a decent period.

Optimizing Grid Quantity and Interval 📏

- More Grids (narrower interval): More frequent, smaller profits, higher trading fees. Better for very low volatility.

- Fewer Grids (wider interval): Less frequent, larger profits per trade, lower trading fees. Better for higher volatility.

The “optimal” setting depends on the asset’s typical volatility and your desired frequency of trades. Ensure the profit per grid covers the trading fees!

Initial Capital Allocation and Risk Management 💰🛡️

- Sufficient Capital: Ensure you have enough capital to cover all potential buy orders within your grid.

- Diversification: Don’t put all your capital into one grid bot. Diversify across multiple bots or strategies.

- Stop-Loss (Bot Stop): Most grid bots allow you to set a stop-loss price for the entire grid. If the price falls below this, the bot stops and sells all remaining assets (often at a loss), limiting downside. Crucial for futures grids.

- Take-Profit (Bot Stop): You can also set a take-profit price for the entire grid. If the price rises above this, the bot stops and takes profits, allowing you to re-evaluate or redeploy.

Arithmetic vs. Geometric Grids ➕✖️

- Arithmetic Grid: Each grid line has an equal price difference (e.g., $10 intervals). Good for low-priced assets or tight ranges.

- Geometric Grid: Each grid line has an equal percentage difference (e.g., 1% intervals). Often preferred for higher-priced assets or wider ranges, as it scales better with price changes.

Monitoring and Adjusting Your Grid 👀

Grid trading bots are not “set and forget.”

* Market Conditions Change: If the market breaks out of your defined range (strong trend up or down), your grid will stop trading and you’ll be left with either all stablecoins (if price shot up) or all the base asset (if price plummeted). You’ll need to adjust or restart the grid.

* Performance Review: Regularly check your bot’s P&L, fees, and overall performance.

Understanding Unrealized P&L in Grid Trading 📉

Your bot dashboard will often show “Unrealized P&L.” This is the floating loss/gain on assets currently held by the bot that haven’t yet been sold. The bot aims for “Grid Profit” (the realized profits from completed buy/sell cycles). Don’t panic if you see unrealized loss, as long as the price remains within your grid and continues to oscillate.

Fees and Slippage Considerations 💸

Every buy and sell trade incurs fees. A grid with too many lines or too narrow intervals might generate frequent trades where the profit per trade is barely more than the fee, making the strategy inefficient. Factor fees into your grid interval calculations. Also, be aware of slippage in very volatile or illiquid markets.

Backtesting and Paper Trading 🧪

Before committing real capital, use platforms that offer backtesting features to simulate how your chosen grid parameters would have performed on historical data. Even better, utilize paper trading or demo accounts to test your strategy in real-time without financial risk.

Limitations and Risks of Grid Trading ⚠️

- Out-of-Range Losses: The biggest risk is when the price breaks strongly out of your defined grid range. You could be left holding a significant bag of the asset if it falls below your lower limit, or you miss further gains if it pumps above your upper limit.

- Drawdowns: During prolonged downtrends, your grid might accumulate assets, leading to significant unrealized losses until the price recovers.

- Capital Lock-up: Your capital is tied up in the grid, which might limit your flexibility to trade other opportunities.

- Maintenance: While automated, grids require occasional review and adjustment, especially in rapidly changing market conditions.

Grid trading is a sophisticated yet accessible strategy for capitalizing on crypto’s inherent volatility. By understanding its mechanics, carefully setting your parameters, and adhering to sound risk management, you can leverage grid bots to generate consistent profits from market oscillations.