How to Avoid Impermanent Loss in DeFi

By Jason Miller – Crypto Writer 10.expert 🧠 Covering Bitcoin, altcoins, blockchain & Web3.

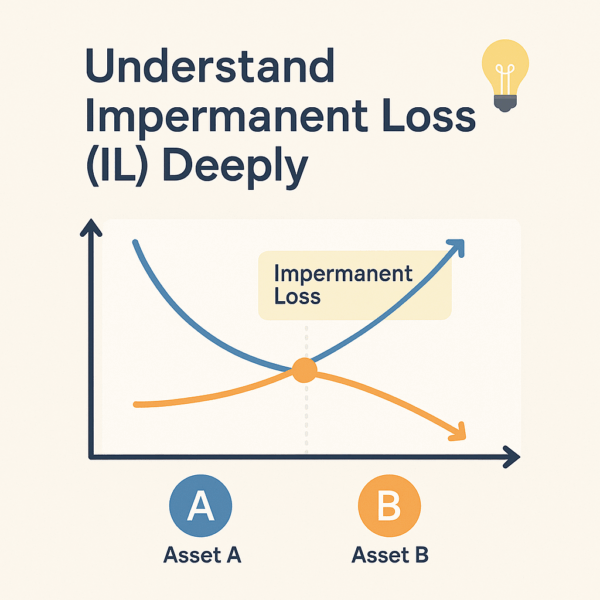

As a crypto writer and analyst, one of the most significant concepts in decentralized finance (DeFi) that can both attract and deter new participants is Impermanent Loss (IL). When you provide liquidity to an Automated Market Maker (AMM) on a decentralized exchange (DEX), you’re essentially depositing two assets into a pool to facilitate trading. Impermanent loss occurs when the price ratio of these two assets changes significantly from the time you deposited them.

While you earn trading fees as a liquidity provider (LP), and sometimes additional yield farming rewards, a substantial price divergence between your pooled assets can result in the value of your LP position being less than if you had simply held the two assets individually in your wallet. The term “impermanent” is key here: the loss only becomes “permanent” if you withdraw your liquidity while the price divergence still exists. If the prices return to their original ratio, the impermanent loss diminishes or even disappears.

In 2025, with the advent of concentrated liquidity pools (like Uniswap V3 and PancakeSwap V3) and more sophisticated DeFi protocols, the nuances of IL have grown. Understanding how to mitigate or even avoid it is crucial for sustainable yield farming and liquidity provision.

Let’s dive into how to avoid or minimize impermanent loss in DeFi.

How to Avoid Impermanent Loss in DeFi: Strategies for Smarter Liquidity Provision 📉🛡️

Impermanent loss is an inherent risk of providing liquidity, but it’s not inescapable. By strategically choosing pools and leveraging advanced features, you can significantly reduce its impact.

Understand Impermanent Loss (IL) Deeply 💡

- Price Divergence: IL occurs when the relative price of the two assets in a liquidity pool changes after you deposit them.

- Arbitrageurs: AMMs maintain a constant product formula. When prices diverge from external markets, arbitrageurs trade with the pool, adjusting its composition until it matches external prices, which means the LP’s share of the pool changes.

- Opportunity Cost: It’s often an opportunity cost, meaning you would have had more value by simply holding the assets (“hodling”) rather than providing liquidity, if you withdraw during the divergence.

Choose Stablecoin Pairs 💰

- Minimizing Volatility: The most effective way to virtually eliminate impermanent loss is to provide liquidity for pairs of assets that are designed to maintain a stable 1:1 price peg.

- Examples: USDC-USDT, DAI-USDT, BUSD-USDC (on their respective chains). Since their prices ideally don’t fluctuate relative to each other, the risk of IL is negligible.

- Lower APRs: The trade-off is that stablecoin pools generally offer lower trading fees and often lower yield farming rewards due to less volatility and high liquidity.

- Move Together: If two assets tend to move in the same direction and magnitude, the price divergence between them will be minimal, thus reducing IL.

- Examples: wETH-stETH (wrapped ETH and staked ETH, like Lido’s stETH), BTCB-wBTC (wrapped Bitcoin on different chains).

- Still Risk: While less risky than uncorrelated assets, correlation can break during extreme market events (e.g., stETH de-pegging from ETH during certain market conditions).

Utilize Single-Sided Liquidity Protocols (Where Available) 🌊

- Specialized Designs: Some newer or niche protocols offer “single-sided liquidity provision,” where you can deposit just one asset. The protocol then handles the pairing and rebalancing, often using complex strategies or internal mechanisms to minimize IL for the user.

- How it Works (Varied): This can involve dynamic hedging, using protocol-owned liquidity, or socialized impermanent loss.

- Research Thoroughly: These protocols can be more complex and may introduce other risks (e.g., smart contract risk, protocol solvency risk).

Farm with Higher Trading Fees & Yield Farming Rewards 🤑

- Offsetting IL: While you can’t avoid IL entirely for volatile pairs, the goal is for the trading fees you earn (and any additional yield farming rewards from staking LP tokens) to outweigh the impermanent loss.

- High Volume Pools: Target pools with high trading volume for your chosen pair, as this translates to higher trading fees for LPs.

- Attractive APRs/APYs: Look for farms offering significant yield farming rewards, but always be wary of unsustainably high numbers which might indicate a less secure or new project.

Use Concentrated Liquidity with Active Management (Uniswap V3, PancakeSwap V3) 🎯

- Capital Efficiency: Protocols like Uniswap V3 and PancakeSwap V3 allow LPs to provide liquidity within specific, narrow price ranges. This “concentrated liquidity” dramatically increases capital efficiency, allowing you to earn more fees with less capital.

- Amplified IL (if out of range): However, if the price of the assets moves outside your chosen range, your liquidity becomes inactive and stops earning fees, and your position becomes 100% of the poorer-performing asset. This effectively amplifies impermanent loss if not managed.

- Active Management: Requires active management: monitoring prices and adjusting your ranges, adding or removing liquidity as prices move, or opting for wider ranges (which are less capital efficient but reduce active management).

Consider Automated LP Strategies & Yield Optimizers 🤖

- Managed Positions: Platforms like Arrakis Finance, Sommelier Protocol, or others specialize in managing concentrated liquidity positions on behalf of users, aiming to optimize fee collection and minimize IL.

- Auto-Compounding: Yield optimizers (e.g., Beefy Finance, Autofarm) often automate the process of harvesting yield farming rewards and re-compounding them back into the farm or pool, boosting APY and helping to offset IL.

- Additional Risk: These platforms add another layer of smart contract risk, so choose reputable ones.

Hedge Your Position (Advanced) 🛡️

- External Hedging: For very sophisticated users, it’s theoretically possible to hedge your impermanent loss exposure by taking a short position on one of the assets in your LP pair on a derivatives exchange.

- Complexity & Cost: This is highly complex, requires active management, and incurs additional trading fees and liquidation risks on the hedging platform. Not recommended for most users.

Invest in Pools with Impermanent Loss Protection ☂️

- Evolving Feature: Some protocols are experimenting with built-in impermanent loss protection mechanisms, often by charging a small fee for withdrawals, or using an insurance fund, or subsidizing LPs with additional tokens.

- Research Model: Thoroughly research how these protection mechanisms work and their limitations.

Analyze Historical Volatility of the Pair 🕰️

- Tools & Data: Before providing liquidity, use tools and analytics platforms (e.g., DefiLlama, Dune Analytics dashboards for specific protocols) to analyze the historical volatility and price correlation of the chosen token pair.

- High Volatility = Higher IL Risk: The higher the historical divergence, the greater the potential for impermanent loss.

Use Impermanent Loss Calculators 🧮

- Estimate Potential Loss: Websites offer impermanent loss calculators where you input your initial deposit amounts and current prices to estimate the potential IL you might face. This helps in assessing risk.

Diversify Your Liquidity Positions ⚖️

- Spread Risk: Instead of putting all your liquidity into one highly volatile pool, diversify across multiple pools with different asset correlations and risk profiles. This spreads the risk of IL.

Be Patient: The “Impermanent” Nature 🧘

- Waiting Game: If prices diverge, your IL is only realized when you withdraw. If you believe the relative prices of the assets will eventually return closer to your initial deposit ratio, waiting might be the best strategy to reduce or eliminate the impermanent loss.

- Opportunity Cost: This requires patience and means your capital is locked up, potentially missing other opportunities.

Avoid New, Highly Volatile, or Low-Liquidity Pairs 🚫

- Extreme Risk: New tokens, meme coins, or pairs with very low liquidity are highly susceptible to extreme price swings and therefore massive impermanent loss. The trading fees from such pools are often insufficient to cover the IL.

- Rug Pull Risk: These also carry a higher risk of “rug pulls,” where developers drain the liquidity.

Continuously Monitor Your Positions 🚨

- Active Oversight: Regardless of your strategy, actively monitor the performance of your liquidity positions. Keep an eye on price changes, trading volume, and your net earnings (fees + rewards – IL). Be prepared to adjust your strategy or withdraw if conditions become unfavorable.

While impermanent loss is an inherent aspect of providing liquidity to AMMs, it doesn’t have to be a deterrent. By understanding its mechanics and employing strategic approaches, you can significantly mitigate its impact and participate more profitably in the exciting world of DeFi.