How to Place a Limit Order on Binance

By Jason Miller – Crypto Writer 10.expert 🧠 Covering Bitcoin, altcoins, blockchain & Web3.

As a crypto writer and analyst, one of the first things I teach aspiring traders is the difference between a market order and a limit order. While market orders offer immediate execution, they don’t guarantee your desired price. This is where the limit order steps in, providing you with precision and control over your entry and exit points in the volatile crypto market.

Placing a limit order on Binance, the world’s largest exchange, is a fundamental skill that every trader should master. It allows you to set your preferred price, ensuring you don’t overpay when buying or undersell when taking profits. Let’s walk through the process.

How to Place a Limit Order on Binance: Precision Trading for Smart Entries and Exits 🎯💰

A limit order is an instruction to buy or sell a cryptocurrency at a specific price or better. Unlike a market order that executes instantly at the current best available price, a limit order sits on the exchange’s order book until your specified price is met.

Understanding Limit Orders: Control Your Price, Not Just Execution 📈

A limit order is your instruction to the exchange: “Buy this crypto only if its price drops to X or lower,” or “Sell this crypto only if its price rises to Y or higher.” This gives you exact control over your execution price, though it doesn’t guarantee immediate fulfillment.

Why Use a Limit Order? Key Advantages ✅

- Price Control: You get to dictate the exact price you’re willing to buy or sell at.

- Cost Efficiency: You can potentially buy cheaper or sell higher than the current market price.

- “Maker” Fees: Limit orders that are placed and sit on the order book (adding liquidity) often incur lower “maker” fees compared to “taker” fees from market orders.

- Automated Trading: Set it and forget it. You don’t need to constantly monitor the market.

Accessing the Binance Spot Trading Interface 🌐

First, log in to your Binance account. Navigate to the “Trade” section in the top menu bar, and then select “Spot” (or “Classic”/”Advanced” trading interface, depending on your preference).

Selecting Your Trading Pair 🔍

On the trading interface, choose the specific cryptocurrency pair you wish to trade (e.g., BTC/USDT, ETH/BUSD, SOL/USDT). You can use the search bar on the right side of the screen to find your desired pair.

Locating the Order Panel 📊

Scroll down or look for the “Spot” order box, typically located below the chart on the left or right side of the screen. Here, you’ll see options for different order types like “Market,” “Limit,” “Stop-Limit,” etc.

Choosing “Limit” as the Order Type 📝

Click on the “Limit” tab within the order panel. This will display the fields required to place a limit order.

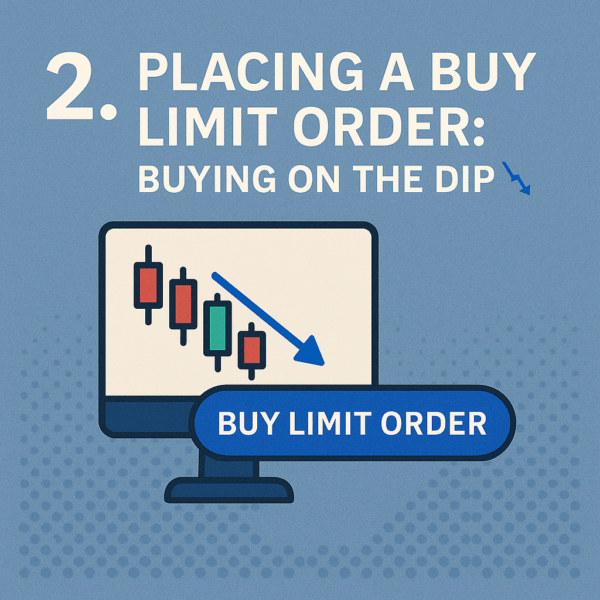

Placing a Buy Limit Order: Buying on the Dip 📉

If you believe the price of a crypto will drop, and you want to buy it at a lower price:

* Ensure you are on the “Buy” side of the order panel (usually green).

* Price: Enter the maximum price you are willing to pay for one unit of the cryptocurrency (e.g., if BTC is $60,000, you might enter $58,500).

* Amount: Enter the quantity of the cryptocurrency you want to buy (e.g., 0.1 BTC).

* Alternatively, you can use the percentage bar (25%, 50%, 75%, 100%) below the “Amount” field to use a specific percentage of your available funds (e.g., USDT) for the purchase. Binance will automatically calculate the amount of crypto you can buy at your specified price.

* Click the “Buy [Crypto Symbol]” button and confirm the order.

Placing a Sell Limit Order: Taking Profit 📈

If you believe the price of a crypto will rise, and you want to sell it at a higher price for profit:

* Ensure you are on the “Sell” side of the order panel (usually red).

* Price: Enter the minimum price you are willing to sell one unit of the cryptocurrency for (e.g., if ETH is $3,000, you might enter $3,200).

* Amount: Enter the quantity of the cryptocurrency you want to sell (e.g., 0.5 ETH).

* Alternatively, use the percentage bar to sell a specific percentage of your holdings.

* Click the “Sell [Crypto Symbol]” button and confirm the order.

Monitoring Your Open Orders 👀

Once placed, your limit order will not execute immediately (unless your limit price is already better than the current market price, in which case it will act like a market order and fill instantly). It will sit in the “Open Orders” section below the trading chart. You can view its status there.

Canceling or Modifying a Limit Order ❌

You can cancel an open limit order at any time before it’s filled. In the “Open Orders” section, simply click the “Cancel” button next to the order. You can also modify an existing order by canceling it and placing a new one.

Partial Fills: Understanding Execution 🤏

Sometimes, a limit order might be “partially filled.” This means only a portion of your order has been executed at your specified price, and the remaining quantity is still waiting on the order book. This often happens with large orders or in less liquid markets.

Time-in-Force (TIF) Options (Advanced) ⏱️

For more advanced users, Binance might offer “Time-in-Force” (TIF) options with limit orders.

* Good ‘Til Canceled (GTC): The order remains active until it’s fully executed or manually canceled (this is often the default).

* Immediate Or Cancel (IOC): Any portion of the order that can be filled immediately at the limit price or better is filled, and the remainder is canceled.

* Fill Or Kill (FOK): The entire order must be filled immediately and completely at the limit price or better, otherwise, it’s canceled.

Limit Order vs. Market Order: When to Use Which 🤔

- Limit Order: Use when you prioritize price control and are willing to wait for your desired price. Ideal for strategic entries/exits, taking profits, or buying dips.

- Market Order: Use when you prioritize immediate execution and are willing to accept the current market price. Ideal for urgent trades or when liquidity is very low.

Fees: Maker vs. Taker 💲

When your limit order is placed and sits on the order book, it “makes” liquidity, and if it fills, you typically pay a lower “maker” fee. If your limit order instantly matches an existing order on the book (because your limit price is better than the current market price), it “takes” liquidity and you might pay a higher “taker” fee.

Practice and Strategy Integration 🧠

Don’t just place random limit orders. Integrate them into your overall trading strategy. Use technical analysis (support/resistance levels, chart patterns) to determine logical price points for your limit buy and sell orders. Practice in small amounts until you’re comfortable.

Mastering the use of limit orders on Binance is a foundational step toward becoming a more precise and profitable crypto trader. It empowers you to take control of your trades, manage your risk, and execute your strategy with greater confidence.