How to Use Trading Bots on Binance

By Jason Miller – Crypto Writer 10.expert 🧠 Covering Bitcoin, altcoins, blockchain & Web3.

As a crypto writer and analyst, I’ve seen how the sheer volume and constant movement of the crypto market can overwhelm even experienced traders. This is where trading bots come into play. Binance, being the largest cryptocurrency exchange, has integrated various bot functionalities directly into its platform, offering traders a powerful way to automate their strategies and capitalize on market movements 24/7.

While trading bots can significantly enhance efficiency and remove emotional biases, they are not a “set it and forget it” solution or a guarantee of profit. Understanding how they work, their risks, and their proper configuration is crucial. Let’s explore how to effectively use trading bots on Binance.

How to Use Trading Bots on Binance: Automate Your Crypto Strategy 🤖✨

Binance offers a suite of integrated trading bots designed to automate various strategies, from steady accumulation to capturing volatility.

Understanding What Trading Bots Are ⚙️

A trading bot is an automated software program that executes buy and sell orders on your behalf based on predefined parameters and strategies. These bots connect to your Binance account via secure API keys and operate around the clock, eliminating the need for constant manual monitoring.

Accessing Binance’s Trading Bot Features 🧭

Log in to your Binance account. From the main navigation bar, usually under the “Trade” or “Tools” section, look for “Trading Bots.” This will take you to the bot dashboard where you can explore the various options.

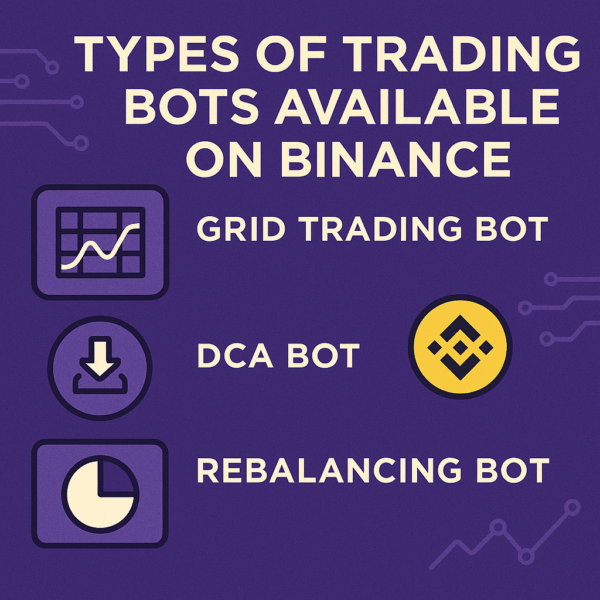

Types of Trading Bots Available on Binance 📊

Binance offers several popular bot types, each suited for different market conditions and strategies:

* Spot Grid Bot: Best for volatile, sideways markets.

* Futures Grid Bot: Similar to Spot Grid, but with leverage for derivatives.

* Spot DCA Bot: Ideal for dollar-cost averaging and managing positions in trending markets.

* Rebalancing Bot: For maintaining a target portfolio allocation.

* Auto-Invest: A simplified DCA tool for long-term accumulation.

Spot Grid Bot: Buying Low, Selling High in a Range 📈

The Spot Grid Bot is designed to profit from price fluctuations within a predefined range. It places a series of buy orders at progressively lower prices and sell orders at progressively higher prices, creating a “grid” of orders.

* Ideal Market: Ranging or sideways markets with clear support and resistance.

* Key Settings: Price Range (upper and lower limits), Number of Grids (density), Investment Amount, Arithmetic vs. Geometric Grid.

* Setup: Choose your trading pair, set your price range based on recent volatility, decide on the number of grids, and allocate capital. Binance often provides “AI” or “Popular” settings for beginners.

Futures Grid Bot: Leveraging Volatility with Caution 💰

The Futures Grid Bot operates on the same principle as the Spot Grid Bot but in the futures market, allowing for leverage. This amplifies both potential profits and losses.

* Key Differences: Involves leverage, margin modes (Isolated/Cross), and funding rates.

* Higher Risk: Due to leverage, liquidation risk is significant.

* Setup: Similar to Spot Grid, but you also need to select leverage and margin mode. Start with very low leverage if you use this bot.

Spot DCA Bot: Strategic Dollar-Cost Averaging 📅

Unlike the simpler “Auto-Invest” (which is purely about recurring buys), the Spot DCA Bot on Binance is more dynamic. It buys more when the price dips (averaging down) and can automatically sell when a profit target is hit.

* Ideal Market: Trending markets (up or down) or volatile markets where you want to accumulate.

* Key Settings: Base/Quote coin, Initial Order size, Safety Order size, Price Deviation for Safety Orders, Take Profit target, Max Safety Orders.

* Setup: Define your initial buy, how much more to buy on dips (safety orders), and your overall profit target.

Rebalancing Bot: Portfolio Maintenance Automation 🔄

The Rebalancing Bot helps you maintain a desired asset allocation in your portfolio. If one asset performs well and its percentage in your portfolio increases, the bot will sell some of it and buy others to bring your portfolio back to its target proportions.

* Ideal For: Long-term investors who want to stick to a diversified portfolio strategy without manual rebalancing.

* Key Settings: Portfolio of coins, Target Weight for each coin, Rebalance Threshold (e.g., rebalance when any coin’s weight deviates by 5%), Rebalance Cycle (time-based rebalance).

Auto-Invest: The Simplest DCA for Beginners 💲

While technically a bot, Auto-Invest is Binance’s most basic form of DCA. It’s designed purely for recurring purchases without complex trading parameters.

* Setup: Select a coin (or portfolio), set a fixed amount, choose a frequency (daily, weekly, monthly), and select your payment method.

* Ideal For: Long-term accumulation and true dollar-cost averaging without active trading.

API Keys and Security: Connecting Your Bot Safely 🔐

For any bot (whether Binance’s built-in ones or third-party), you’ll need to generate API keys on Binance.

* Crucially: When generating API keys, NEVER enable withdrawal permissions. Only enable “Spot and Margin Trading” and “Futures Trading” (if using futures bots) permissions. This ensures the bot can trade on your behalf but cannot withdraw your funds.

* IP Whitelisting: If using a third-party bot, whitelist their specific IP addresses for added security.

Backtesting and Paper Trading: Test Before You Invest 🧪

Many bots (especially grid bots) allow for backtesting (simulating the bot’s performance on historical data). Utilize this to get an idea of how a strategy might have performed. Better yet, if a “paper trading” or “demo trading” option is available, use it to test your bot settings with virtual money before deploying real capital.

Monitoring and Optimization: Bots Aren’t “Set and Forget” 👀

While bots automate trades, they require regular monitoring.

* Market Conditions Change: A bot optimized for a ranging market will underperform or lose money in a strong trend (and vice versa). You’ll need to pause, adjust settings, or switch strategies.

* Performance Review: Regularly check your bot’s P&L, fees, and number of trades. Optimize settings if performance lags.

Understanding Fees: Maker/Taker and Funding Rates 💸

Be aware of the fees associated with bot trading.

* Trading Fees: Every buy and sell order executed by the bot incurs standard Binance spot or futures trading fees (maker/taker). Frequent trading can lead to substantial fee accumulation.

* Funding Rates (Futures): Futures grid bots are subject to funding rates, which can eat into profits or even add to losses if you’re consistently on the wrong side of the funding payment.

Risk Management: Always Set Stop-Loss and Take-Profit 🛑✅

Most Binance bots allow you to set overall stop-loss and take-profit levels for the entire bot strategy.

* Bot Stop-Loss: If the price moves too far against your strategy, the bot will automatically stop and close all open positions, limiting your maximum loss.

* Bot Take-Profit: If the overall profit generated by the bot reaches a certain level, it will stop and close positions, locking in gains.

These are essential, especially for leveraged futures bots.

Start Small and Learn Gradually 🌱

Never deploy a significant amount of capital into a new bot strategy until you fully understand its mechanics and have tested it with smaller sums. Increase your investment gradually as you gain confidence and see consistent results.

Limitations and Risks of Trading Bots ⚠️

- Not Magic Wands: Bots follow algorithms; they don’t adapt to unforeseen news or black swan events.

- Requires Knowledge: Proper configuration requires market understanding.

- Potential Losses: Bots can and will lose money if market conditions are unfavorable or settings are incorrect.

- Technical Issues: Bots can experience glitches or connectivity issues.

Binance’s trading bots offer a powerful pathway to automated crypto trading, enabling efficiency and emotionless execution. By understanding the different types, their settings, and critically, managing your risks, you can potentially leverage these tools to enhance your trading performance. But always remember: the human element of oversight and strategy adjustment remains paramount.